A variety of industries and individuals around the country are experiencing some anxiety right now over the proposed Republican tax plan. The bill would change many of the largest tax deductions in the United States, including charitable contributions. Nonprofit organizations should be particularly concerned, despite the GOP’s promise to preserve the deduction for charitable donations. Here’s why.

The Plan

H.R.1, known as the “Tax Cuts and Jobs Act”, is the House bill that Republicans promise will grow the economy, create jobs, and simplify tax returns to the size of a postcard. If passed, the bill will roughly double the standard deduction taxpayers receive (in lieu of itemizing) to $12,000 for individuals and $24,000 for couples. As promised, tax breaks for charitable contributions would remain, but there will be little incentive for taxpayers to file itemized deductions this way. Currently, an estimated third of all taxpayers itemize deductions, including charitable donations. The Tax Policy Center estimates that of the 45 million tax filers who itemize, 38 million (84%) of them would opt for the new standard deduction because it would exceed the combined value of other deductions available to them.

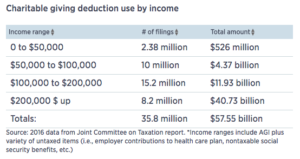

Proponents of the bill argue that significant tax cuts could lead to taxpayers having more money to give to charity, but industry experts are very skeptical of this outcome and insist that the federal incentive for charitable contributions is very powerful. The GOP bill enables wealthy Americans to continue deducting their charitable giving, while many middle- and upper-middle class families will no longer receive this tax break as they would not itemize deductions. Una Osili, from the Lilly Family School of Philanthropy at Indiana University, explained to NPR that the tax plan doesn’t mean people will stop giving, just that they’re likely to give less.

The Impact on Nonprofit Organizations

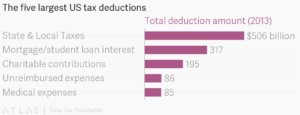

Charitable contributions are one of the largest cumulative tax deductions used in the United States, so any major change to that deduction will be disruptive. According to the Tax Policy Center, the Republican tax plan could reduce individual giving by 4.5-9%, or as much as $26 billion per year. The bill will also eventually eliminate the estate tax, which could discourage billions more in giving from wealthy individuals who do not want to subject their heirs to the tax.

Simultaneously, Congress is also trying to cut spending on domestic programs. So depending on the mission of a nonprofit, they could be encountering more need for their work and less money to fund it.

What To Do

As a response to the Republican tax plan, some nonprofits are pushing Congress to include a universal charitable deduction, which taxpayers would receive on top of the standard deduction. Rep. Mark Walker (R-NC) proposed setting a universal charitable deduction at around $2,100 for individuals and $4,200 for couples.

The estimated impact of this bill may sound scary to many of our nonprofit partners out there. Remember that agility is the key to survival in times of change. It is important to know what it takes for programs to run successfully and what parts should be prioritized if there is a need to cut back, even just for a while as donors begin to understand how their taxes will change. Development and fundraising teams should have prepared answers for donors when they have comments or questions about tax changes. Keep donors informed and excited about your work, even during turbulent times.

Sources:

- H.R. 1: “Tax Cuts and Jobs Act”

- NPR: Nonprofits Fear House Republican Tax Bill Would Hurt Charitable Giving, Pam Fessler, November 4, 2017

- CNBC: GOP tax plan trashes the value of two popular tax breaks, Sarah O’Brien, September 26, 2017

- The National Council for Behavioral Health: Industry Experts: President Trump’s Tax Plan Could Hurt Nonprofits, Stephanie Pellitt, May 4, 2017

- The Philadelphia Inquirer: Nonprofits kept under fire in Senate GOP tax plan, Harold Brubaker, November 13, 2017

- The Washington Post: Winners and Losers in the GOP Tax Plan, Heather Long, November 2, 2017

- Chicago Tribune: Charities fear GOP tax plan could lead to loss of billions of dollars in donations, Robert Channick, November 13, 2017